Less-common Transaction Types

General Journal Entry

Interest Earned

Non-offering Deposits

Refunds of purchases

Insurance Payouts

Evangelism Funds from the Conference

Bank Fees

Check-printing Charges

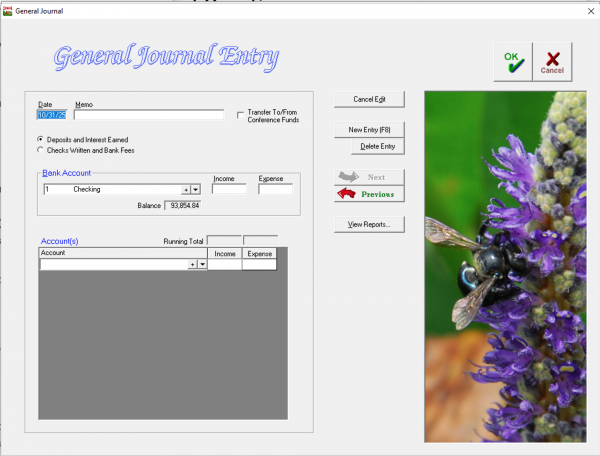

If you need to make an accounting entry for a transaction which does not fit anywhere else in Jewel's accounting process, such as the list above, you can make a General Journal Entry. The General Journal is for entering items such as bank fees, interest earned, deposits that are not offerings (refunds on purchases, rebates, insurance payouts, funds received for local use from the conference), specific types of corrections, etc.

Do NOT use General Journal Entry for: offering deposits, transfers, checks or other payments, offering reversals, budget allocation, or anything else that you can find a specific method to enter.

To make an entry:

- From the Jewel Home Screen, select Accounting then Make General Journal Entry; or click General Journal Entry in the Bank Reconciliation screen. You can also use the "Interest Earned or Deposit Correction" and "Bank Fees or Check Correction" buttons in the Bank Reconciliation screen, as these are simply shortened General Journal entries.

- Type in the appropriate date (Jewel defaults to today's date).

- Type a Memo describing the transaction. It is very important to type a memo for every General Journal Entry so you will be able to keep track of what the transaction was for.

- Choose whether you wish your transaction to appear on Deposit reports or on Check reports, by choosing Deposits and Interests Earned OR Checks Written and Bank Fees.

- Select the correct bank account, and enter the amount being added (Income) or subtracted (Expense).

- Select the appropriate church fund(s) and enter the Income or Expense for each account.

- To complete the entry, click OK or “New Entry.”

As always in Fund Accounting, the total taken from or added to your local funds must be EQUAL to the amount you are subtracting/adding to your bank account.

Credit Balance with a Vendor

Neither accounts payable nor credit balances with vendors are reflected in Jewel. Most church accounting programs, including Jewel, are cash basis, not accrual, accounting. There a couple of ways you can handle vendor credits.

- Request a refund. When the refund is received, deposit into the bank in a separate, non-Sabbath deposit. The simplest way to post a non-offering deposit to Jewel is via "General Journal Entry" in the lower right-hand corner of the Reconciliation page. You may also post it by going to Accounting -> Make General Journal Entry. Be sure to post the refund to the church account which was first charged for the expense. If the credit is from a prior year and the accounts have been zero-ed out at year-end, then you would post the refund to Church Budget.

- Wait until future purchases zero out or reverse the credit balance.

Contribution Receipt For Donated Items

You’re handed a board approved receipt from a recent purchase and told, “I don’t want to be reimbursed, just give me credit on my year-end contribution report.” How do I record the contribution?

- Write an electronic payment check to that person (no check number, no actual payment is made).

- Fill out an offering envelope from that person as if they gave you the electronic payment check and record it as a separate offering on a date other than a Sabbath.

- On your next bank reconciliation, clear both the electronic payment check and the deposit as neither will ever appear on a bank statement.

If you are given an article donation, but there is no recent purchase receipt, you may give a letter signed by the treasurer thanking the person for the donation of (description of item or items) to the church. But the church does not assign a monetary value to the donation, and the donation will not appear on year-end receipts.

Other Online Giving Deposits

Why Not to Use Them

We at Jewel Church Accounting System are aware that some churches are using peer-to-peer (P2P) payment apps such as Zelle and CashApp to accept donations from their members. More recently, some are using online giving platforms like Tithely. However, there are some very real and important issues involved with substituting these apps for AdventistGiving, an app specifically designed for the North American Division of the Seventh-day Adventist church. Please encourage your members to use the AdventistGiving app. Most donors, if they know what’s easiest and best for you, will be happy to switch.

While P2P apps do include an optional memo, they do not require donors to specify the funds they wish to donate to. This puts an extra burden on the treasurer to verify and track the donors' wishes, and opens the door for miscommunication, misunderstanding, and accusations of misappropriation. P2P apps are NOT designed for the purpose of making church contributions. For the protection of our Treasurers and Donors, we recommend that churches NOT use these apps.

Online giving apps are a definite improvement over P2P apps, since they require donors to specify the fund(s) they are donating to. However, the local church treasurer is responsible for setting up all funds, while AdventistGiving comes with all Conference Funds already set up, in addition to the common Local Funds, all arranged in a format that's easy for donors to use. Also, these apps charge fees which the treasurer must enter separately from the donations, while AdventistGiving is free to the local church. And other apps do not produce reports that can be imported into Jewel.

Only AdventistGiving is set up specifically for Adventist donations, automatically collects all the necessary information about the donation, and passes it on seamlessly to the Treasurer to be imported directly into Jewel, saving time and virtually eliminating mistakes and misunderstandings. Our advice is that Adventist churches use only the AdventistGiving app/website to receive funds electronically. We suggest that you periodically place the following or a similar announcement in your church bulletin to inform your church members:

Online giving: AdventistGiving is the official giving app of the Seventh-day Adventist Church. Please make every effort to use this app for your giving, as it saves steps for you and your hardworking treasurer. AdventistGiving seamlessly transmits your fund designations and imports directly into our Jewel Church Accounting program, saving time, effort and errors in entering donations and maintaining church records. Use AdventistGiving, and your treasurer will thank you!

Another perspective on Online Donation Apps.

Using P2P Apps

If you feel that you must accept donations via peer-to-peer (P2P) apps such as Zelle or CashApp, here are the steps necessary for appropriate tracking. It is imperative that the church treasurer creates/designs a spreadsheet to keep track of the contributions from each of the various P2P platforms that your church chooses to use. For each app, you must:

- At the end of each period, e.g. the 15th and 31st of each month, go online to the bank account or app and record all the extra donations from that app.

- Print out the donation information from the app or from the donor's email or other communication to the church treasurer regarding donation allocation. File these in a way that allows the auditor to easily trace which Jewel deposit they correspond to.

- On a spreadsheet, enter the date, donor name, total amount, and allocation of the funds donated.

- Prepare a deposit in Jewel for the total amount received from that app during that period, using a different offering date from the regular collection of weekly church offering envelopes. (If the app charges fees, the Offering Total should equal the amount deposited, not the amount donated.)

- If fees were charged, enter a Jewel envelope with a negative total for the fees. The Donor Name can be Anonymous/No Name, or you can set up a specific Donor Name for fees. The Account can be Church Budget, or you can set up a specific account. Either way, all amounts on this envelope should be negative.

- Enter a Jewel envelope for each contribution with name of the donor, total amount and allocation of funds donated. On the Make Deposit screen, use the Memo to, record the beginning and ending dates of the offering period and which app the donations are from, e.g. Zelle donations 2/1/25-2/15/25.

- For apps such as CashApp that require manual transfer of funds from the app to the church bank account, transfer the exact amount of the deposit you just entered into Jewel. For apps that periodically transfer funds automatically, ensure that your Jewel deposit matches the amount the app deposited, and choose the app’s period so that donations end up credited to the calendar month in which they were donated. For apps that deposit directly into your bank account, ensure that your Jewel deposit matches the total of the donations from that app during the same designated period.

- Then at month-end when doing the bank reconciliation, the cleared deposit will be the total deposit for that period's spreadsheet (not the individual donations from Zelle, CashApp, etc.)

- At year-end, you may need to do a separate deposit for transactions that were initiated before midnight on 12/31, but were not deposited until January. These transactions must be recorded in December.

Using Online Giving Apps

If your church has decided to accept donations via other online giving apps such as Tithely, here are the steps necessary for appropriate tracking. For each app, you must:

- Choose the period you wish the app to use for deposits. It is easiest to have the app make deposits twice per month or weekly. Avoiding depositing each day's donations separately, as tracking that many deposits is difficult.

- Ensure that the funds on the app are set up correctly to correspond to the Local and Conference funds you have set up in Jewel.

- At the end of each period, e.g. the 15th and 31st of each month, go online to the bank account or app and prepare a deposit in Jewel for the total amount received from that app during that period, using a different offering date from the regular collection of weekly church offering envelopes. (If the app charges fees, the Offering Total should equal the amount deposited, not the amount donated.)

- If fees were charged, enter a Jewel envelope with a negative total for the fees. The Donor Name can be Anonymous/No Name, or you can set up a specific Donor Name for fees. The Account can be Church Budget, or you can set up a specific account. Either way, all amounts on this envelope should be negative.

- Enter a Jewel envelope for each contribution with name of the donor, total amount and allocation of funds donated. On the Make Deposit screen, use the Memo to, record the beginning and ending dates of the offering period and which app the donations are from, e.g. Tithely donations 2/1/25-2/15/25

- Then at month-end when doing the bank reconciliation, the cleared deposit will be the total deposit for that period from that app.

- At year-end, you may need to do a separate deposit for transactions that were initiated before midnight on 12/31, but were not deposited until January. These transactions must be recorded in December.

- Note that you are entering all donations into Jewel, so at end-of-year the only contribution receipts you send out should be from Jewel. Online giving apps often offer a receipt feature, but sending both a receipt from the app and a Jewel receipt would give double credit for the same donation.

Credit Card Purchases

There are two methods of recording purchases on a church-owned credit card. Read this tutorial to decide if Summary or Detail entry is right for you and your church.

Ingathering Reversion Posting and Usage

Petty Cash Fund Setup and Usage

Religious Liberty Campaign

Religious Liberty Campaign part 1

Religious Liberty Campaign part 2