Budgets for Different Stages Examples

Reminder: Churches go through life stages. No one budgeting method fits all.

Monthly Reports are created so that the church board can see, at a glance, how much money came in, where it was spent, and how much money is available to fund the work of the church.

Take a look at the “Local Funds” section of your “Financial Summary. ” You will see a “Church Budget” or “Combined Budget” line, and probably other lines with a mix of expenses, ministries and projects.

Donors give offerings to Church Budget, Evangelism and some ministries and projects, but they do not typically donate to expenses such as Electricity or Pest Control. So how are Local expense accounts like Lawn Care funded? Through transfers from Church Budget, since those donations can be used wherever needed.

Those transfers, from Church Budget to other places where the money is needed, can be made manually, one by one, or they can be set up in Jewel so that they happen automatically, once a month.

NOTE: This happens in the Local Funds, so it is just on paper. No bank account balances are changed or affected in this process.

Here are some examples of local church budgeting, along with the positives and negatives of each method.

Pays Everything from Church Budget

Church A is a small Mission Group and their expenses are few. They only have a handful of Local Funds and pay most of their bills directly from Church Budget.

- Positive – This is a simple system that is easy to maintain. It requires no transfers.

- Negative – This system does not give much clarity to the financial reports. The board cannot see at a glance how much they are spending on any one expense such as Rent or Fellowship Meal Supplies, since they are all coming out of the same fund.

No Budget, Accounts Left Negative

Church B is a mature church with their own facility and lots of Local Funds, but they have never set up any type of Budget Allocations. They post donations to Church Budget, and they pay bills out of other accounts. At the end of every year, they zero out the negative balances with transfers from Church Budget.

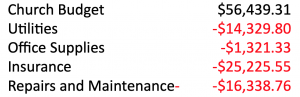

For most of the year, their Financial Summary might look like this. A negative balance means that money has been spent, but Church Budget does not yet reflect that fact.

- Positive – There really are no positives with this method. It looks like they have a lot of money in Church Budget, but they really don’t. They actually have a small negative balance.

- Negative – Negative Ending Balances in Local Funds make it impossible for the board to know at a glance how much money the church actually has. The reports are only clear and simple when the negatives are zeroed out.

No Budget, Accounts Zeroed Out Monthly

Church C has chosen to authorize the treasurer to zero out any negative Ending Balances at the end of each month, taking funds from Church Budget. This can work well for a smaller church with basic expenses and not a lot of active ministries.

- Positive – The church’s financial position is clearly shown and the board can see it at a glance.

- Negative – The treasurer has to manually make the transfers every month, which takes time.

Budget with Fixed Amounts

Church D has their Budget Allocations set up to transfer money from Church Budget automatically to each local expense fund, i.e. Utilities and Office Supplies and Insurance. The monthly budget amounts are calculated from the last 2-3 years of actual expenses.

- Positive – The church’s financial position can be seen clearly, looking at the Ending Balance of the Church Budget Local Fund. Budget Allocations are made by Jewel automatically, so the treasurer has less work to do at month’s end.

- If a church budgets primarily to the monthly expense funds and to ministries that have been given a monthly budget, the Church Budget Ending Balance is typically not zero, and is available to be used when needed for unexpected expenses.

- Negative – If Church Budget income in a particular month is less than total Budget Allocations, adjustments may be needed. (see Church G)

Budget with Percentages

Church E has set up Budget Allocations using percentages, which means that every dollar that comes in to Church Budget is divided out, every month, to the various expenses and ministries, based on their particular percentage.

- Positive – The Budget Allocations are made automatically without monthly treasurer input.

- Negative – Expense funds do not receive consistent and predictable allocations, which can leave things like Utilities or Mortgage with negative balances (see Church F). It all depends on the monthly donations, which can vary. Also, this method leaves the Church Budget account with a zero balance at the end of every month, which can make it difficult to cover unexpected expenses when they occur. Percentages are harder to calculate than whole numbers, and if they are off just a bit, one Local Fund can accumulate thousands of dollars while other Local Funds have large negative balances.

Budget with Mix of Fixed Amounts and Percentages

Church F might allocate whole numbers to funds such as rent that have predictable expenses, then whatever is left in Church Budget is allocated by percentage to ministries. (Yes, Jewel will let you set it up that way.) That way, funds such as Mortgage receive their full amount, and if any is left over, other chosen funds can receive a portion.

Budget with Fixed Amounts, Excess to Reserves

Church G moves any end of month Church Budget balances to a Reserves or Contingencies fund. On months when offerings are down, money can be moved from this fund back to Church Budget to make up the difference.

Summary

As you can see, there is no one way to do it. Each strategy has its positives and negatives. Tech support is happy to help, whether you are setting up allocations for the first time or are considering changing from one method to another.