Avoid Creating Duplicate Offerings

Duplicate offerings are a hassle. They inflate your Deposit Report, your Financial Summary, your donors end-of-year receipts and sometimes your Remittance check to the Conference. To fix all those things, you can’t just void or delete them – they have to be reversed, envelope by envelope, often by an auditor.

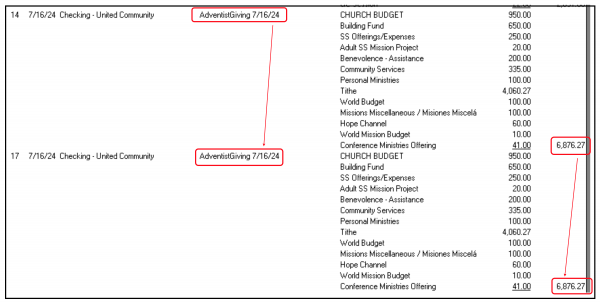

This is how it might look on your deposit report.

It is also possible that the duplicate could be posted to a different month, where it would be a bit harder to locate.

In addition to the fact that unnecessary time has been spent entering the exact same thing twice, a duplicate offering means that now those envelopes have to each be entered again in order to be reversed. Like I said, somewhat of a hassle.

Creating a system to avoid creating duplicate offerings in the first place is worth the effort.

Here are some tips:

- Create a system that reminds you when you have already posted an offering. Maybe a colored checkmark on the corner of the tithe envelope verification sheet – something that will stand out to you.

- Learn how to find your Deposit Report in Jewel (Reports and Graphs / Deposit), and check it often for duplicates. If you are ever unsure, go look. If Jewel gives you a message that you deposited that same amount recently, don’t ignore it. Check it out. Also, good offering memos and dates can help catch duplicates.

- Especially for Adventist Giving, learn which deposits belong in which month, date each deposit correctly, and be very vigilant about it. Check the previous month's deposit report as well if you are not sure if you have doubled up.

- Jewel will warn you if you have already imported an AdventistGiving offering. And it will tell you if you are entering an offering that is the same date or amount of one already entered. Don’t ignore that warning.

How do you know if you have already duplicated an offering? You will see a deposit at the top of the “Deposits and Interest Earned section on your bank reconcile page that does not go away. It is normal to have one or two deposits left over that do not reach the bank by the end of the current month, but if you have one that is more than 30 days old, it is nearly always a duplicate. If you see one like that, you may need to contact your tech support for assistance.

If you can verify that the extra deposit is a duplicate and want to try to reverse it yourself, click here for instructions. You may be due a credit on your next month’s remittance, and reversing the duplicate is the way to get it back.

Click here for more topics related to Cleaning Up and Ensuring Accuracy