Bank Reconciliation

The Bank Reconciliation is an essential part of treasury work. Its purpose is to verify that your records in Jewel agree with what is actually happening in your bank account. Reconciling makes sure that you entered all transactions in Jewel and that you entered them correctly, as well as giving you a chance to catch any errors the bank may have made, or any fraudulent transactions.

Best practice is to reconcile monthly before closing the month. This allows you to catch mistakes or omissions when they are easiest to correct. However, if you cannot reconcile during your month-end closing for some reason, you may do so at any point during the monthly process of any future month by clicking Reconcile on the Jewel Home Screen. Keep in mind, though, that postponing or skipping reconciliation means that your Jewel records may not accurately reflect what has happened at the bank. Also, there is usually a strict time frame for reporting fraudulent transactions. So reconciliations should always be completed as soon as possible after receiving the bank statement.

Here's why bank recs are such a big deal!

Basic Steps

Here are the steps to follow when performing your Bank Reconciliation:

- On the Jewel Home Screen, click the NextStep button when it says Reconcile Bank Statements, or click Reconcile.

- You will see a list of accounts waiting to be reconciled. Those that still need to be reconciled this month will be in bold. Note that you can adjust the Statement Frequency for each bank account in Maintenance / Edit Accounts (and Never is an option, if you no longer wish the account to appear here).

- Double-click on the account you are reconciling, or select the account and click Reconcile.

- Look at your Bank Statement and find the Ending Date. Make sure it matches the Ending Date pre-filled in Jewel. If the difference is only a few days, correct the date in Jewel. If Jewel's date is in the wrong month, figure out why by looking at Previous Bank Recs or contact technical support for help. (Note that you can change the

- Look at your Bank Statement and find the Beginning Balance for this period. Make sure that it matches the Beginning balance pre-filled in Jewel. If not, contact technical support for help.

- Look at your Bank Statement and find the Ending Balance for this period. Enter this amount in the Ending text box.

- Compare the transactions on your Bank Statement to the transactions in Jewel. Every transaction on your bank statement should be recorded in Jewel, exactly as it appears on your bank statement. Work your way down the bank statement, matching each transaction with a corresponding transaction in Jewel, and checking off each transaction in Jewel as you find it.

- If a transaction should match but doesn't, then Jewel must be corrected. Follow the link to instructions for specific corrections here, noting that the Bank Reconciliation screen has shortcuts to the Check and Deposit reports, to Write Checks, and to Make General Journal entry, which can help make corrections faster.

- If a transaction on the bank statement is missing from Jewel, it must be added. Follow the link to instructions for adding missing transactions here.

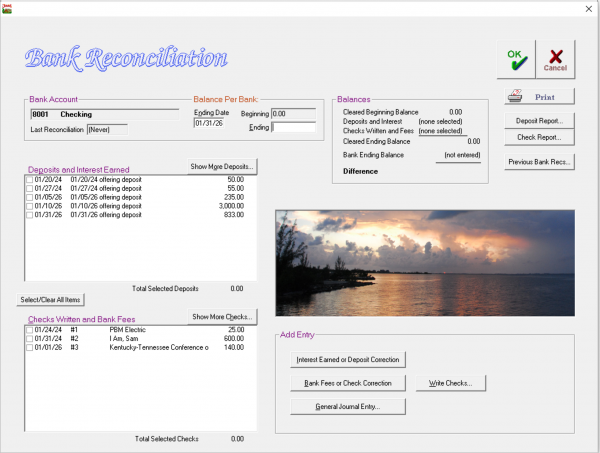

- When you have checked off a corresponding entry in Jewel for each and every transaction on the bank statement, the Difference in Jewel (just above the sunset picture) will be $0.00. Click OK to complete the Bank Reconciliation and print your Bank Reconciliation Report.

- Repeat for each bank account needing reconciliation. Then click Finished All Bank Reconciliations to proceed to the next step.

If you wish to leave the reconciliation at any point before reaching a Difference of $0.00, click Cancel, then Yes to save your work.

Here's a pictorial tour of Jewel's bank reconciliation.

Adding Missing Transactions

First click "Show More Deposits" or "Show More Checks" to see if the transaction was recorded outside of the reconciliation date range. If you see it, check it off, then click OK to return to the regular reconciliation screen. You can also access your Check Report and Deposit Reports from the Bank Rec screen, where it may be easier to search for the transactions. Be very sure that the transaction is truly missing before adding a new one, as double entries will make your books inaccurate.

Interest earned

Click "Interest Earned or Deposit Correction". Fill in the abbreviated General Journal form, including the Local Fund to credit the interest to. Many small churches simply credit the interest to Church Budget. Larger churches may wish to create a specific fund to track interest income. Click Add Entry to finish.

Bank Fees

Click "Bank Fees or Check Correction". Fill in the abbreviated General Journal form, including the Local Fund to charge the fee to. Most churches will charge fees to Church Budget or to a separate Bank Fees fund if they wish to track more closely. Click Add Entry to finish.

Offering Deposits

Cancel out of the bank reconciliation (click Cancel, then Yes to save your work) back to the Jewel home page.

If the NextStep button says Start New Offering, then enter the missing offering as usual. If the NextStep button says Remit to Conference, go to Offerings (at the top of the page), then Start New Offering, and enter the offering as usual.

If the NextStep button says anything else, contact tech support for assistance. Or you can wait to finish the reconciliation and enter the offering in the next month, as long as it will still be in the same calendar year. It's OK, although not best practice, to enter a July offering on August 1. It is not acceptable to enter a December offering in January, per IRS regulations.

Non-offering deposits

Click General Journal Entry (below the picture). Fill in the memo to indicate the source of the funds and any other pertinent information. Fill in the amount of income, and the Local Fund(s) that the income should be credited to. Click OK to finish and return to the reconciliation.

Checks or other payments

Click Write Checks (below the picture). Fill out the check form as usual (clicking Electronic Payment if appropriate). Click OK to finish and return to the reconciliation.

Note that checks and other payments should not be entered as General Journal entries, or via "Bank Fees and Check Corrections". The reasons why are listed here.

Remittance check

Contact tech support for assistance.