Credit Card Transaction Entry - Detail Version

When a church obtains a credit card, the purchases can be recorded and managed in Jewel one of two ways.

Summary Version: Monthly purchases are reported on the statement, but not recorded individually in Jewel. The monthly balance is paid by a check or electronic payment, and the various purchases are combined and posted to appropriate local funds using the “Account” lines on the check. Click here for instructions for this method.

Detail Version: The credit card is set up as a bank account in Jewel. Each individual purchase is entered as an “electronic payment” in that Jewel account and the account is reconciled monthly. This is the method described on this page.

The method of credit card entry that a church chooses should be based on:

- How much the card is utilized – the monthly ending balance owed

- How many separate credit cards are in use

- How much detail for budgeting and tracking the board wishes to have

- The organizational capabilities of the local church treasurer

Detail Version

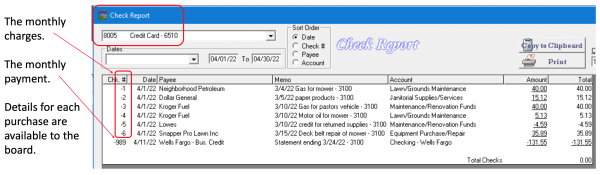

The Credit Card is set up as a bank account in Jewel. Each purchase is entered into Jewel as an electronic check from that bank account, and its details show on the check report.

The Credit Card account is reconciled monthly to ensure accuracy.

Advantages of Detail Entry

- Detail for each purchase is contained on the check report and so is available to the board.

- Expenses can be traced, both for budgeting and for analysis

- User accountability is available, since it can be easily determined whose card was used for what purchase

Disadvantages of Detail Entry

- More complex. Works best for an organized and detail-oriented treasurer

- The time lag between the actual purchase, the date the statement is posted and the payment date makes it impossible to post the purchase in its actual month in Jewel.

- A system for dating and posting must be strictly followed, or confusion can be the result.

Because of variables in cards and statements, if you are interested in setting up your church’s credit card as a bank account, contact your support person for assistance and your database can be customized for your situation.

Detail Version Entry Instructions

Enter all the credit purchases for the month by going to “Write Checks” in Jewel. Make sure to change the bank account to your credit card account (whatever it is called in your database) on each payment as you enter it. You do not want these payments showing up on your checking account reconcile page.

- Check #: Ignore it. The check # will disappear once you click the “Electronic Payment” box.

- Date: Enter the exact posting date from the credit card statement.

- Amount: The total of the purchase on the credit card statement.

- Pay to the Order Of: The names on the statement can sometimes be abbreviated. Figure them out and enter the correct name.

- Memo: Create a memo for each entry, using the credit card receipts that have been turned in, to describe both the purchase and the purpose. Be specific. Use date ranges for utility bills.

- Account: Post each purchase to the correct local fund.

- Electronic Payment: Finish by making sure the “Electronic Payment” box is clicked.

If you have another credit card purchase to enter, use the “New Check” button on the right side of the screen to continue.

- NOTE: If you find you have entered a check under the wrong bank account, go find that check and edit it right then. Use the red “Previous” arrow on the right side of the Write Checks screen, or find and click on the payment in your Check Report. Don't create a second payment. Fix the one you already created before you close the month.

Editing a Payment's Bank Account

Find the check that is posted to the wrong bank account. You can click the red "Previous" arrow on the right side of the Write Checks screen, or find and click on the payment in your Check Report. Click on “Edit Check”. Using the drop down box in the upper left corner, choose the correct bank account. Click on the “OK √” in the top right corner to save and close.

When You Have Many Credit Card Transactions

Pro tip to speed up credit card entries: Before starting the credit card bank rec process, if you have a number of credit card transactions to enter, do the following.

- Go to Maintenance / Properties / Accounts tab

- Using the drop-down menu, temporarily change the “Default Checking Account” from checking to the credit card bank account, so that the electronic payments that you are about to enter will all post to the credit card account, without you having to reset the bank account for each check individually.

IMPORTANT: When finished entering all the credit card charges, return to Maintenance / Properties / Accounts and reset the “Default Checking Account” back to checking. Otherwise your next checks will post to the credit card account and you will need help to fix them if you don't catch the error before closing the month.