The Basic Jewel Processes

Welcome to the Jewel monthly cycle, guided by the NextStep button! We hope you will see how Jewel has made a fairly complicated process quite simple.

The NextStep button in the center of your Jewel Home Screen is your guide through the monthly accounting process. The item listed beside NextStep will change according to where you are in the accounting process - reminding you of where you left off and what your next step is. During most of the monthly cycle, that next step is Start New Offering.

Receiving and Handling Offerings

Counting the Offering

Before you can enter an offering in Jewel, the offering must be counted. This is a critical step that must be done following Internal Controls to prevent dishonesty, help avoid accusations, and to catch potential counting errors. Dual Counting--having two people present whenever an offering is being counted--is a critical part of those controls. If you have any questions regarding safe, correct procedures for counting the offering, please consult your conference treasury or auditing department.

Start New Offering - Recording Offering in Jewel

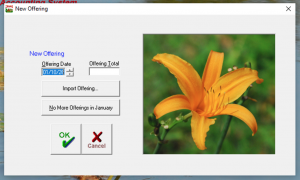

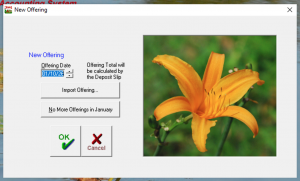

To begin entering a new offering, click the NextStep button when it reads “Start New Offering.” In the window that opens, select the date the offering was collected. Jewel automatically brings up the offering date of the Sabbath after your last offering entry. If you need to change the date, use the up and down arrows or type in the appropriate date manually.

If you are not using the Deposit Slip feature of Jewel, enter the offering total here, as calculated by counting the offering, and then click OK. If you ARE using the Deposit Slip, click OK now and the offering total will be calculated in the Deposit Slip. The Deposit Slip feature can be toggled on and off by going to Maintenance -> Properties -> General tab.

If you are entering an AdventistGiving offering, simply click "Import Offering". You do not need to enter a date or a total, as Jewel will get those details from the import. Next steps for AdventistGiving imports are found here.

Deposit Slip

The deposit slip in Jewel is a great way to simplify the counting process. Once the envelope totals have been verified by counting their contents, you can use the deposit slip as a re-count of all of the cash and checks to ensure that no mistakes were made in the first steps of counting. You will come to a grand total, which should equal the total already arrived at by adding together the envelope totals.

On the Deposit Slip Screen in the upper left corner, note the offering date, date of deposit, and the bank you will be depositing into and change if needed. Now, notice there are columns for coins, bills, and checks. Enter in the total number of pennies, dimes, dollar bills, etc in their respective text boxes. Then type in each check, pressing enter after each to make a new field. Entering the check number may be optional (depending on your settings in Properties), but provides a better record on year-end donation receipts. As you see on the right-hand side of the screen, Jewel calculates a grand total for you. Compare this with the totals from the previous counting, ensuring that they are equal. Once finished, you can click Print Deposit Slip in the upper right hand corner, then use this deposit slip when depositing the money in the bank. When you have finished and printed, click OK. Like nearly everything in Jewel, if for some reason you need to make a change later, you will be able to do so until you have completed the month-end closing process.

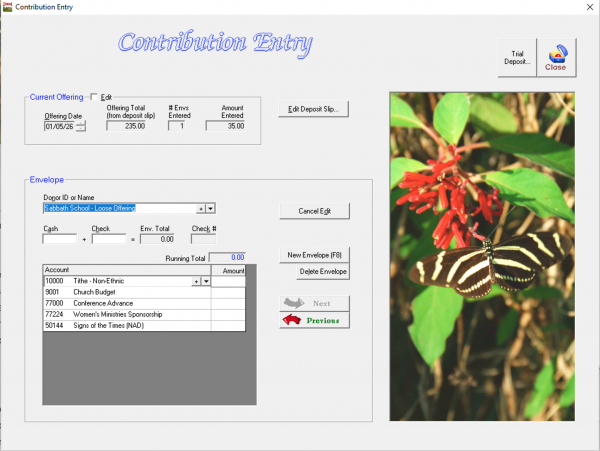

Contribution Entry

In this step, you will be entering the data from each individual tithe envelope. Jewel will use this data to make financial reports (thereby keeping track of budget and cash flow) and to make receipts at the end of the year for each donor.

Follow these simple steps for entering envelopes:

- First, select the donor. You can start typing in the name, or click the small down arrow at the end of the text box and select from the list. You can also add a donor by clicking the (+) sign next to the down arrow. Once you have entered the new donor's information in the Edit Names screen, click OK to return to Contribution Entry.

- Enter the amount of Cash and/or Checks included in this envelope. If you are using the Deposit Slip feature, Jewel will transfer the check numbers for you. Otherwise, enter them yourself. If you are entering electronic donations, use the Check field, and enter the source of the donation (AdventistGiving, etc) in the Check Number field.

- Next, select the appropriate account(s) donated to on this envelope. As with selecting the donor name, either type in the account name (or number) or click the down arrow and select from the list. You can also Edit/Add accounts by clicking the (+) sign, which takes you to the Edit Accounts screen. Click OK to save changes, and you will be returned to Contribution Entry. After entering the amount donated, press Enter to open another account line.

- Jewel will automatically start a New Envelope if you press Enter when your account Running Total matches the Envelope Total. Jewel will not allow you to move to a New Envelope until those two totals match.

- Follow these steps for all envelopes, being very careful to enter the correct amounts into the correct accounts. Once the Amount Entered (the total of envelopes entered) equals the Offering Total, Jewel will prompt you to proceed to Make Deposit.

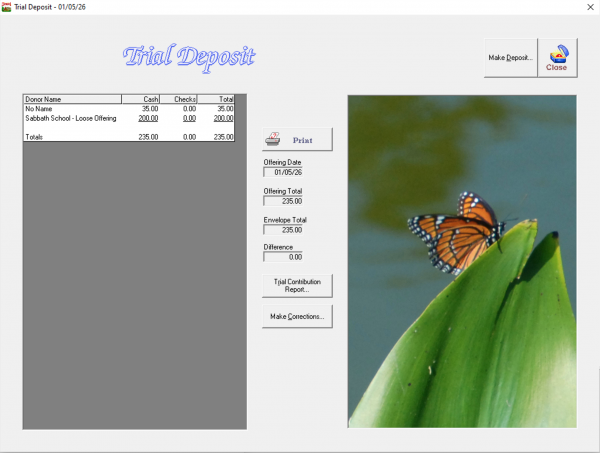

Trial Deposit

If your envelope total equals the offering total, a trial deposit may not be necessary. However, if you're having trouble getting the Amount Entered to equal the Offering Total, Trial Deposit (in the upper right corner of the Contribution Entry screen) will aid you in finding the problem. Compare your paper envelopes with the list of envelopes entered into Jewel on the Trial Deposit screen. If an envelope was mis-entered, click on that envelope in the list, click Edit Envelope, and make your corrections. If the problem is the offering total, click Make Corrections. Then check the Edit box at the top left of the Contribution Entry screen to change the deposit total. Or click Edit Deposit Slip, if you are using that feature, and make your corrections there. Once you are satisfied that all data has been entered correctly, click Make Deposit.

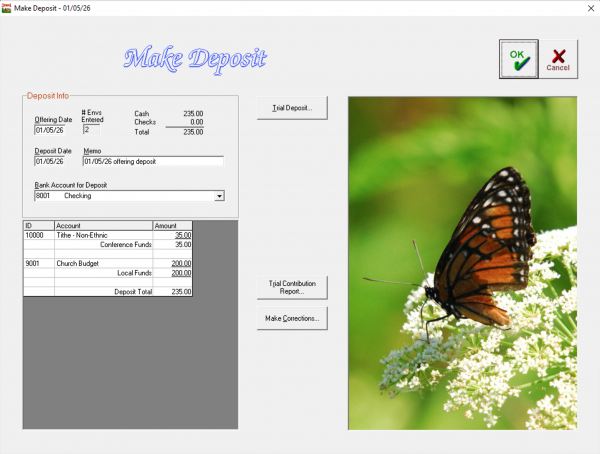

Make Deposit

This step completes the process of entering your offering. When you click "OK", the Jewel software makes the appropriate accounting entries according to the envelopes you have entered. Jewel will enter the total into your checking account record, and distribute funds into your church and conference funds as indicated on each envelope. The envelopes entered will not actually appear on your records in Jewel until this step has been completed.

Review the information shown on the screen. You can click Trial Deposit or Make Corrections if something is wrong. You can also change the deposit date, memo, and checking account information if necessary. If all information is correct, click OK to complete the recording of the deposit in Jewel.

Month End

You have the NextStep button to guide you through the month-end processes. You don't need to remember what to do next!

There are two ways to begin the month end process. The easiest and most common is that after you have clicked "Make Deposit" for the last Sabbath of the month, Jewel will ask if you have entered all offerings for the month. Double-check the list of offerings shown, making sure to include AdventistGiving if appropriate. If all deposits have been entered, click 'Yes' to begin the month-end process.

If you mistakenly click the wrong option, go to Offerings in the top menu bar, and select Start New Offering or No More Offerings This Month, depending on which you need.

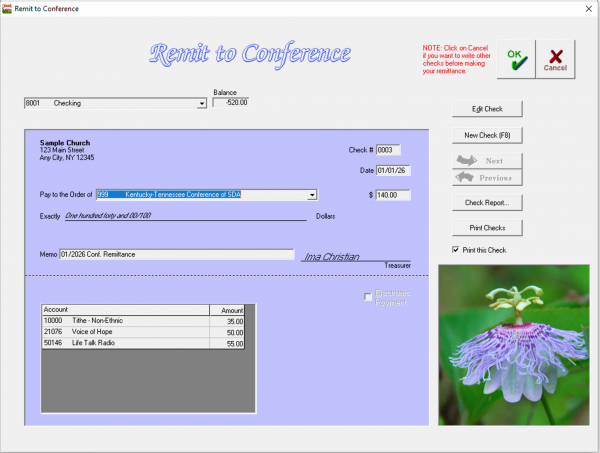

Remit to Conference

Your NextStep button now says Remit to Conference. This is the point where you send the Tithe and other Conference Funds to the conference. Under no circumstances are funds intended for conference use to be removed and used for local church purposes. Clicking Remit to Conference brings up the actual check or ACH remittance you will send in to the conference. Jewel has already calculated how much you owe the conference for this month, as well as how the funds are to be disbursed at the conference (note the list of accounts with their respective values in the bottom half of the check). You should never need to change the amounts! Jewel automatically accounts for any corrections that have been made, NSF checks received, etc.

If you write your checks by hand, double-check that the Check Number is correct. If you send your remittance via ACH, verify that the Electronic Payment box is checked. If you need to change one of these things, click Edit Check and make your change.

NOTE: The remittance check CANNOT be written using Write Checks, as Conference Funds cannot be selected in that screen. In the unlikely circumstance that you need to write a remittance check outside of the monthly cycle, you must go to Accounting -> Make Manual Remittance.

Send Remittance Report

If your conference uses Jewel as its official treasury software, your next step is to Send Remittance Report. This sends the breakdown of funds on the remittance check to the conference in electronic form. If you have not set up ACH with your conference, the report saves them from having to deal with a physical report in addition to your physical check. If you have set up ACH, the report tells the conference how much to withdraw from your bank account.

Make Budget Allocations

If you have set up a budget in Jewel, your next step will be to confirm those allocations for the next month. This screen shows the budget allocations that Jewel will make for the next month, based on what you have entered. Simply click OK to record the transfer. If you need to make changes, click Cancel, go to the menu bar at the top of the main screen, select Maintenance → Budget Allocations and make necessary changes. If you do not wish to set up a budget in Jewel, click the NextStep button anyway, then confirm that you wish to continue without setting up budget allocations.

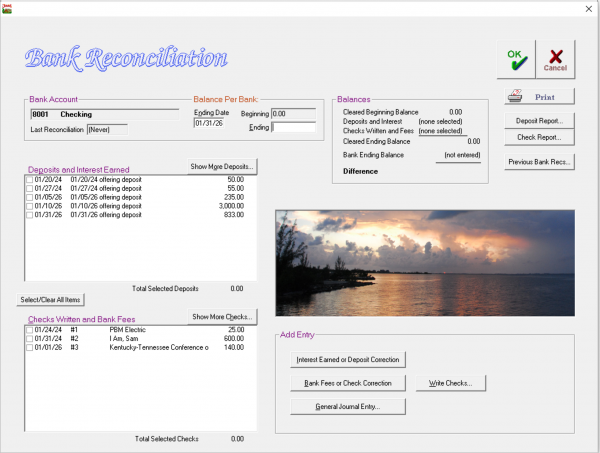

Reconcile Bank Statements

The next step in the month-end closing process is Reconcile Bank Statements. The purpose of the Bank Reconciliation is to verify that your records in Jewel agree with what actually happened in your bank account. Reconciling makes sure that you entered all transactions in Jewel and that you entered them correctly, as well as giving you a chance to catch any errors the bank may have made, or any fraudulent transactions.

Please note that while best practice is to reconcile monthly before closing the month, it is not imperative to do so. If you cannot reconcile during your month-end closing for some reason, click Reconcile Bank Statements, then click Finished All Bank Reconciliations to move on to the next step in the closing process. Do reconcile as soon as you can, though, using the Reconcile link on the Jewel Home Page.

Here are the steps to follow when performing your Bank Reconciliation:

- On the Jewel Home Screen, click the NextStep button when it says Reconcile Bank Statements, or click Reconcile.

- Double-click on the account you are reconciling, or select the account and click Reconcile.

- Look at your Bank Statement and find the Ending Date. Make sure it matches the Ending Date pre-filled in Jewel. If the difference is only a few days, correct the date in Jewel. If Jewel's date is in the wrong month, figure out why by looking at Previous Bank Recs or contact technical support for help.

- Look at your Bank Statement and find the Beginning Balance for this period. Make sure that it matches the Beginning balance pre-filled in Jewel. If not, contact technical support for help.

- Look at your Bank Statement and find the Ending Balance for this period. Enter this amount in the Ending text box.

- Compare the transactions on your Bank Statement to the transactions in Jewel. Every transaction on your bank statement should be recorded in Jewel, exactly as it appears on your bank statement. Work your way down the bank statement, matching each transaction with a corresponding transaction in Jewel, and checking off each transaction in Jewel as you find it.

- If a transaction should match but doesn't, then Jewel must be corrected. Follow the link to instructions for specific corrections here, noting that the Bank Reconciliation screen has shortcuts to the Check and Deposit reports, to Write Checks, and to Make General Journal entry, which can help make corrections faster.

- If a transaction on the bank statement is missing from Jewel, it must be added. Follow the link to instructions for adding missing transactions here.

- When you have checked off a corresponding entry in Jewel for each and every transaction on the bank statement, the Difference in Jewel (just above the sunset picture) will be $0.00. Click OK to complete the Bank Reconciliation and print your Bank Reconciliation Report.

- Repeat for each bank account needing reconciliation. Then click Finished All Bank Reconciliations to proceed to the next step.

If you wish to leave the reconciliation at any point before reaching a Difference of $0.00, click Cancel, then Yes to save your work.

Print Monthly Reports

Next, a box will pop up stating that you are about to print monthly reports and close the month. Jewel is pre-set to print the typical monthly reports, which include: Financial Summary (month- AND year-to-date), Contribution Report, Deposit Report, Checks Written Report, and Transfer/Allocation Report. However, you can always change which reports will print by going to Properties → Reports Tab (see Reports). Check with your Church Board to find out which reports they require.

As noted in the pop-up, you cannot make any changes after the month has been closed. Make sure you have entered ALL transactions for the month BEFORE completing this step. The only way to make corrections after closing the month is for you to make a correcting entry in the following month, or to ask support for help.

Back Up Data

Your next step is to make a backup of the data you have entered for the month. This will ensure that, even if something goes wrong with the Jewel application or your computer, you will have your data stored elsewhere, so as to not lose it. Simply insert a USB drive (memory stick) into the appropriate port on your computer, then click Back Up Data on the NextStep button. Keep your USB drive in a safe place but NOT with the computer.

Send Backup to Conference

The last monthly step is sending a back up to your Conference server. This is one more assurance that you will not lose your data, and also serves as your month-end reports to your Conference. Just click the NextStep where it says "Send Backup to Conference", and your backup will automatically be sent. (If you bought Jewel independently of your conference, then your backup goes to Jewel's server. In this case it is not a report to your conference, but is still an extra assurance that your data will not be lost.)

Ongoing Duties

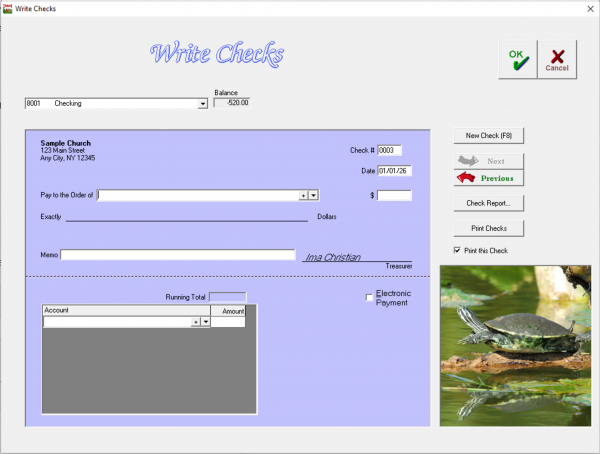

Checks and other Payments

In Jewel, all payments are made in the Write Checks screen, whether you print a physical check with Jewel, hand-write a paper check, use a debit/credit card, or send an electronic payment. Checking the Electronic Payment box removes the Check Number field, so use that for anything that is not a paper check. Otherwise, fill out the check as usual. Note that the total check amount must equal the Running Total of the Accounts listed in the bottom portion of the check.

Checking the Print this Check box at the right means that the current check will be included the next time you click Print Checks. Whether this option is automatically checked or not can be toggled on and off in Maintenance -> Properties -> General tab.

Best practice is to enter all of your checks for the month before starting the month-end closing process. Doing this means that your Remittance check will be the last check written for the month, and that all checks will show on your Bank Reconciliation report. However, it is possible to enter checks at any time during the month, up until you Print Monthly Reports.

When you want to enter any type of payment, from your Jewel Home Screen, select "Write Checks".

- Verify that the church and bank information shown is correct. If not, correct it in Properties

- The check number is automatic and you should not generally need to change it. If you are hand-writing checks or using pre-printed checks, verify that the check number matches the paper check you plan to use. If you are entering a non-check form of payment, check the Electronic Payment box. This removes the check number entirely.

- The date is automatically set to today's date, according to the date on your computer's system. You can also set Jewel so that it brings up the date of the last check written in Properties.

- Type in the Payee, or choose from the list using the down arrow. Remember you can use the (+) sign to add or edit a name and then return to writing your check.

- The dollar amount (as well as memo and account breakdown) of the most recent check written to this vendor will be automatically entered. If necessary, change this information to what you need THIS current check written for. After typing in the correct amount, press Enter.

- Enter a Memo in the memo text box, indicating what the check is being written for.

- Choose the Account(s) the check is to be taken from.

At this point, you can either print this check (ensure “Print this Check” is marked, then click “Print Checks”) or write more checks (click “New Check”, or press F8). You can print multiple checks by ensuring “Print this Check” is marked for each check, then clicking “Print Checks” when you are finished writing all your checks.

Important: If you still want to hand-write your checks, you can. But you MUST write the check in Jewel as well so that the check information can be stored and kept in Jewel's records. This is necessary to keep your books accurate and reliable!

Electronic Payments

Rather than writing a check, you may need to simply record that a payment has been made out of a church account, without using a check number. These payments are recorded in Write Checks, following the same steps as above, except that instead of making sure you have the right check number, you will mark the Electronic Payment box. Use this procedure for electronic bill pay, automatic debits, and credit/debit card transactions.

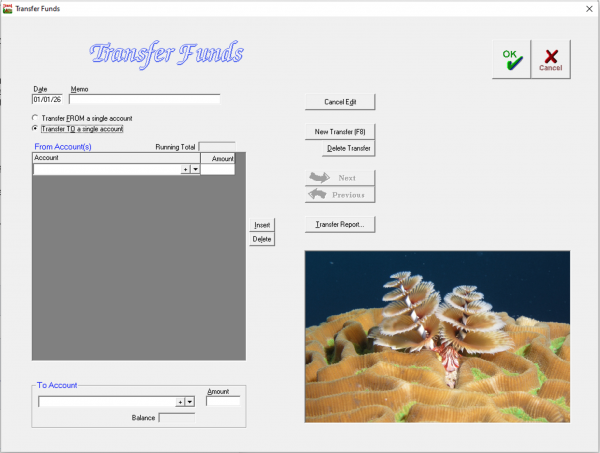

Transfers

Jewel allows two types of transfers, both done in the Transfer Funds screen. You can transfer funds between two Bank Accounts, such as from checking to savings. Or you can transfer funds between two Local Funds, such as from Church Budget to Utilities. Use the Memo field to indicate the reason for the transfer, such as "Per board vote on 5/17/26".

Best practice for transfers is also to enter them before starting the month-end closing process, but they also can be entered at any time during the month, up until you Print Monthly Reports.

For more detailed information on entering transfers, see Chapter 5.

Transfer Funds

On occasion, you may need to transfer funds from one account to another. For instance, say your Pathfinder group needs $50 more than they have in their account right now to make an important purchase. If the church board has approved the transfer, you can take $50 out of one account and put it into the Pathfinder Fund. To transfer funds in Jewel, follow these instructions:

- Click on Transfer Funds on the Home Screen.

- Look in the upper left corner. The date defaults to today's date, but can be edited if needed. Now type in the memo - noting any information you may need to identify this transfer, such as what the money is actually going to be used for, or the date of board approval.

- You have the option to transfer in or out of multiple accounts. This is in case you need to take money from multiple funds and put into one OR take money from a single account and divide it among multiple funds. Select whichever method you would like to use by clicking the small white circle beside your preferred option. Notice how the screen changes when you select either one. It will expand the TO or FROM accounts so that you can enter multiple accounts. If you are making a transfer from a single account into a single account, it does not matter which of these is selected.

- Now, select the account(s) the money is being transferred out of - either by typing it in or selecting from a list with the down arrow. Then for each account type in how much money is to be transferred. To insert an account, either press ENTER after the previous account keyed in, OR click the insert button.

- Next, select the account(s) the money is being transferred in to and how much money is to be transferred in. The amount being transferred in must be the same as the amount you transferred out. You can't take $50 out and transfer in $60!

- When finished, click OK and you're done! Jewel will make the appropriate adjustments in the records.

Note that you can look at a record of previous transfers by clicking the "Transfer Report" button.

Bank Reconciliation

Best practice is to reconcile monthly before closing the month. However, it is not imperative to do so. If you cannot reconcile during your month-end closing for some reason, you may do so at any point during the monthly process of any future month by clicking Reconcile on the Jewel Home Screen. Keep in mind, though, that reconciliation is essential to ensuring that your Jewel records accurately reflect what has happened at the bank. Also, there is often a strict time frame for reporting fraudulent transactions. So reconciliations should always be completed as soon as possible after receiving the bank statement. Please click here for the steps to follow.

General Journal Entry

If you need to make an accounting entry for a transaction which does not fit anywhere else in Jewel's accounting process, you can make that entry here. The General Journal is for entering items such as bank fees, interest earned, deposits that are not offerings (refunds on purchases, rebates, insurance payouts, funds received for local use from the conference, etc.).

NOTE: Do NOT use General Journal Entry for: offering deposits, transfers, checks or other payments, NSF reversals, budget allocation, or bank reconciliation (except as described in Make Corrections).

To make an entry:

- From the Jewel Home Screen, select Accounting, then Make General Journal Entry, or click General Journal Entry in the Bank Reconciliation screen.

- Type in the appropriate date (Jewel defaults to today's date).

- Type a Memo describing the transaction. It is very important to type a memo for every General Journal Entry so you will be able to keep track of what the transaction was for.

- Choose whether you wish your transaction to appear on Deposit reports or on Check reports, by choosing Deposits and Interests Earned OR Checks Written and Bank Fees.

- Select the correct bank account, and enter the amount being added (Income) or subtracted (Expense).

- Select the appropriate church fund(s) and enter the Income or Expense for each account.

- To complete the entry, click OK or “New Entry.”

NOTE: The total taken from or added to your local funds must be EQUAL to the amount you are subtracting/adding to your bank account.

Void a Check

If you need to void a check that you have previously written, go to Accounting -> Void a Check.

- Use the sort options to find and select the check you wish to void.

- Verify that the date and memo accurately record what you are doing.

- Click OK.

The check you selected has been recorded as void. Jewel will either edit the check to make the amounts $0 (if the check is in the current month) or record a new transaction in the current month to cancel out the check that you're voiding. In the Bank Reconciliation, you will then mark off the $0 check, or both the original check and the new transaction, to remove them from the list of checks waiting to be cleared. Since the total amount you are checking off is $0, it will not affect your balance.

NSF Check Reversal

The NSF Check Reversal's purpose is to keep record of non-sufficient fund checks (bounced checks) or other reversed offerings and their corresponding bank fees, if applicable. An NSF Check reversal can be performed at any time, even in months after the offering was received.

We say "check", because that's the type of offering that historically has most often bounced, but electronic offerings can also be returned. All electronic offerings should be entered as "Checks" rather than as "Cash" so that if they are returned, you can use Jewel's NSF Check Reversal feature to easily reverse the offering.

To record that an offering was reversed, go to Offerings -> NSF Check Reversal.

- Use the Time Period and Sort Order options to find the offering you need to reverse.

- Select the offering you are looking for. Make SURE you select the correct one!

- If your bank does not charge a fee, simply leave the Account and Expense boxes blank. If your bank has charged a fee for the NSF check, enter that information here. Select which account to take the charge from and enter the amount charged.

- Verify that the Date and Memo accurately record what you are doing.

- Click OK to complete the NSF check reversal.

Import from AdventistGiving

Jewel can import offering information from AdventistGiving. You may, of course, manually type in AdventistGiving offerings just like you do your Sabbath offerings. If you have very few donors, this is not an undue burden. Just be sure that you copy from AdventistGiving's Official Deposit Report, issued on the 15th and last day of each month, and not the notifications of individual donations that you receive throughout the month. The Cut-off Date is the offering date, since donations should be recorded in the same month they were donated, regardless of when they were deposited.

However, if you have more than a very few donations each month, you will find it much easier and faster to import your AdventistGiving offerings.

Direct Import

The easiest method imports the most recent AdventistGiving Deposit Report. To use this method:

- Click Start New Offering, then Import Offering. You do not need to enter a date or offering total, as Jewel will receive this information from AdventistGiving.

- Enter the Email and Password that you use to log in to the AdventistGiving website, then click Import from AdventistGiving.

- Any accounts that appear in red must be "mapped". Select the account you wish to map and click Map Account. Select the Jewel account that corresponds to the AdventistGiving account you are mapping, or add a new Jewel account, then click OK.

- Any donors that appear in red must be mapped. Select the donor you wish to map and click Map Donor. Select the existing Jewel donor that corresponds to the AdventistGiving donor you are mapping, or add a new Jewel donor, then click OK.

- Once you don't see any more red, all accounts and donors have been mapped. Click OK to move on to the Make Deposit screen.

- Check that all deposit information looks correct, and click OK to record the deposit.

Import from a File

If you need to import a Deposit Report that is not the most recent report, you will need to import from a file.

- Go to the AdventistGiving website, and log in to your Treasury account.

- Download the Official Deposit Report for the cut-off date you need to import. The .csv version works most consistently for Jewel import. Note where the file is saved on your computer.

- Back in Jewel, click Start New Offering, then Import Offering. You do not need to enter a date or offering total, as Jewel will receive this information from AdventistGiving.

- Click Import from a File. You do not need to enter your email or password.

- Find and select the Official Deposit Report you just downloaded, then click Open.

- Any accounts that appear in red must be "mapped". Select the account you wish to map and click Map Account. Select the Jewel account that corresponds to the AdventistGiving account you are mapping, or add a new Jewel account, then click OK.

- Any donors that appear in red must be mapped. Select the donor you wish to map and click Map Donor. Select the existing Jewel donor that corresponds to the AdventistGiving donor you are mapping, or add a new Jewel donor, then click OK.

- Once you don't see any more red, all accounts and donors have been mapped. Click OK to move on to the Make Deposit screen.

- Check that all deposit information looks correct, and click OK to record the deposit.

Year End

There are two year ends you will encounter - the Fiscal and the Calendar. Most likely these will coincide at the end of December of each year. However, some churches end their fiscal year at some other time during the year - usually June 30. For the fiscal year end, you will be required to make a budget allocation (if your church has made a budget), print year- and month-end reports, and back up data. For the calendar year end, you will follow the same steps for month end with the addition of printing and distributing contribution receipts. Whether you are performing a fiscal year end, calendar year end, or both - Jewel's NextStep button will guide you through the steps you need to take.

Once you have completed the last offering of the fiscal/calendar year end, Jewel will begin guiding you through the year end process with the Next Step button.

Budget Allocation

If you wish to re-use this year's Budget Allocations for next year, you will need to manually transfer these them to the next fiscal year before you close. Go to Maintenance -> Edit Budget Allocations, and click Copy from This Year to Next Year. Once the allocations are copied, you can edit them at any time during the fiscal year. You can also add a new budget at any time during the fiscal year.

Contribution Receipts

Contribution Receipts must be printed and distributed after the end of each calendar year, regardless of whether the fiscal year has ended as well. Jewel automatically prints these receipts during the year-end process included in December's closing. These receipts are to be distributed promptly for the donors' records and tax returns. You can mail them, email them, or have the donors pick up the receipts from you.

Print Reports

If you are doing only a calendar year end, Jewel will print only the regular month-end reports. If you are performing fiscal year end, Jewel will print both month-end as well as year-end reports.

Back Up Data

Follow the same process here as for month-end.

Form 1099 Payments

This report assists in the preparation of IRS Form 1099, which in the United States must be provided to each vendor who has been paid more than a specified cumulative amount during the year. First select the time period you want. Click on the Choose Form 1099 Payments button, then select a vendor. This screen shows all payments made to the vendor, and allows you to choose the payments that apply to Form 1099. When finished adding all the vendors that need a Form 1099, click OK. Jewel then generates a report of vendors and their total payments, from which you can then generate your Forms 1099 in the manner recommended by your conference.