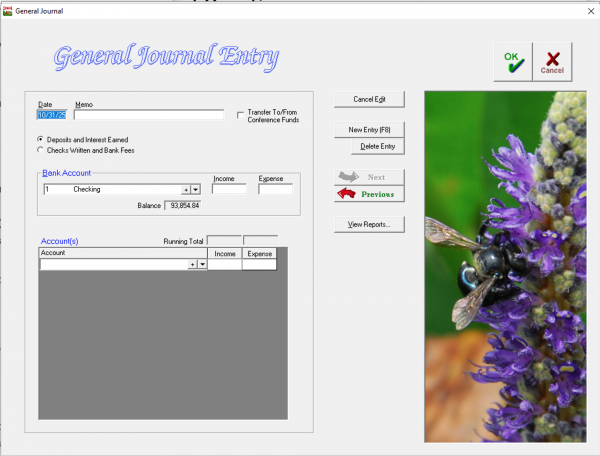

General Journal Entry

If you need to make an accounting entry for a transaction which does not fit anywhere else in Jewel's accounting process, you can make a General Journal Entry. The General Journal is for entering items such as bank fees, interest earned, deposits that are not offerings (refunds on purchases, rebates, insurance payouts, funds received for local use from the conference), specific types of corrections, etc.

Do NOT use General Journal Entry for: offering deposits, transfers, checks or other payments, offering reversals, budget allocation, or anything else that you can find a specific method to enter.

To make an entry:

- From the Jewel Home Screen, select Accounting then Make General Journal Entry; or click General Journal Entry in the Bank Reconciliation screen. You can also use the "Interest Earned or Deposit Correction" and "Bank Fees or Check Correction" buttons in the Bank Reconciliation screen, as these are simply shortened General Journal entries.

- Type in the appropriate date (Jewel defaults to today's date).

- Type a Memo describing the transaction. It is very important to type a memo for every General Journal Entry so you will be able to keep track of what the transaction was for.

- Choose whether you wish your transaction to appear on Deposit reports or on Check reports, by choosing Deposits and Interests Earned OR Checks Written and Bank Fees.

- Select the correct bank account, and enter the amount being added (Income) or subtracted (Expense).

- Select the appropriate church fund(s) and enter the Income or Expense for each account.

- To complete the entry, click OK or “New Entry.”

As always in Fund Accounting, the total taken from or added to your local funds must be EQUAL to the amount you are subtracting/adding to your bank account.