Moving or Spending: Difference between revisions

(Created page with "In Financial Summary 101, we learned that: * The “Bank Accounts” and “Local/Conference Fund” Ending Balances will always match. * Jewel’s check and deposit entry requires that you enter the same money two ways, to ensure that the Ending Balances of the Bank Accounts and Local/Conference Funds always match. Now let’s talk about a different scenario, where money is moved, not spent. '''Moving money doesn’t change the Total Ending Balance'''. When church...") |

No edit summary |

||

| Line 35: | Line 35: | ||

Of course, no rule would be complete without an exception, so here it is. | Of course, no rule would be complete without an exception, so here it is. | ||

When you are writing an actual check in order to make the transfer between bank accounts (example: mailing a check to the Revolving Fund, since they don’t accept Electronic Transfers) you can write the check to them in such a way that it creates a transfer in Jewel. Once that is done, you do not need to use “Transfer Funds.” This check, written correctly, is all you need. [[Transferring by Writing a Check|Click here]] for instructions.]] | When you are writing an actual check in order to make the transfer between bank accounts (example: mailing a check to the Revolving Fund, since they don’t accept Electronic Transfers) you can write the check to them in such a way that it creates a transfer in Jewel. Once that is done, you do not need to use “Transfer Funds.” This check, written correctly, is all you need. [[Transferring by Writing a Check|Click here]] for instructions.]] | ||

<br><br> | |||

----- | |||

[[Maintaining and Customizing Jewel|Click here for more topics related to Pro Tips]] | |||

Revision as of 16:00, 26 December 2025

In Financial Summary 101, we learned that:

- The “Bank Accounts” and “Local/Conference Fund” Ending Balances will always match.

- Jewel’s check and deposit entry requires that you enter the same money two ways, to ensure that the Ending Balances of the Bank Accounts and Local/Conference Funds always match.

Now let’s talk about a different scenario, where money is moved, not spent.

Moving money doesn’t change the Total Ending Balance. When church money is moved (transferred) from one bank account to another, it does not (and should not) affect the “Total Bank Accounts Balance.” You still have the same amount of money. It is just being moved to a different bank account.

You could keep everything in one checking account or divide it up among 100 different bank accounts, and the total money that your church has won’t change. You have what you have, whatever bank account it is in.

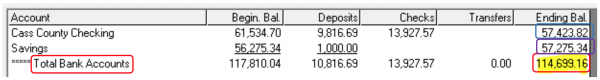

Here is a sample Financial Summary with the “Total Bank Accounts Ending Balance.”

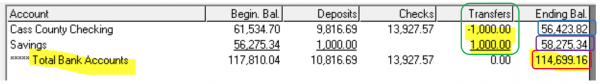

And here it is after a transfer of $1,000 from checking to a different bank account. Could be debit or SURF as well.

Note that the “Total Bank Account Ending Balance” has not changed. But that the checking has $1,000 less and savings has $1,000 more. And that the report clearly shows, in the transfer column, what has taken place.

Jewel provides a clean, simple way to record money that is moved between bank accounts, called “Transfer Funds,” and found on Jewel’s home page, just beneath “Write Checks.” A transfer gives you a “From Account” and a “To Account,” where you can enter two bank accounts.

Often, I see where a treasurer needs to make a transfer, intends to make a transfer, thinks they are making a transfer, will even call it a transfer in the memo line, but then, rather than using “Transfer Funds” they will try to accomplish this transfer using a “General Journal Entry.”

But remember, with a General Journal Entry, both a bank account and a local fund are affected. And we need to record money moving between two bank accounts.

In fact, when a transfer between bank accounts is made, local funds should not be affected. And if they are, your reports will be inaccurate.

Some treasurers have figured out how to manipulate the “General Journal Entry” to create a transfer, but this puts the transaction in the Deposit column of the Financial Summary instead of the Transfer column, making the report unclear.

NOTE: Clarity in the reports is one of the treasurer’s most important tasks. We do all this so that the board can read and understand the reports, so aiming for simple and accurate is important while also making sure the reports are clear.

An easy way to know when to use “Transfer Funds” is to ask yourself this question:

“Am I spending this money or am I moving it?” Do I want the Financial Summary to show that this money is spent/gone? Or that we still have it, just in a different bank account?

- If you are spending it, then both a bank account and a local fund should both be involved, and ending balances of both local funds and bank accounts will decrease.

- If you are moving it from one bank account to another, no local funds should be involved and ending balances will stay the same.

Of course, no rule would be complete without an exception, so here it is. When you are writing an actual check in order to make the transfer between bank accounts (example: mailing a check to the Revolving Fund, since they don’t accept Electronic Transfers) you can write the check to them in such a way that it creates a transfer in Jewel. Once that is done, you do not need to use “Transfer Funds.” This check, written correctly, is all you need. Click here for instructions.]]