Financial Summary 101: Difference between revisions

(Created page with ":'''''NOTE:''' To comply with denomination policies, state and IRS laws and to prevent fraud, our church treasurers keep detailed records of all financial transactions, both incoming and outgoing. Jewel preserves these records and creates various reports so that the board can monitor the church’s financial health and make good financial decisions.'' ==Three Sections== Each Jewel “Financial Summary” consists of three sections. Your church’s Financial Summary, no...") |

|||

| Line 31: | Line 31: | ||

Three sections, working together to give your board the information it needs to do its job. | Three sections, working together to give your board the information it needs to do its job. | ||

==Keeping Things Balanced== | |||

'''Writing checks''': Have you ever noticed that, when you write a check in Jewel, you have to enter the amount of the check twice? | |||

If you write a check to Walmart for $376.41, it decreases the balance of this checking account by $376.41. But you must also subtract $376.41 from a local fund, such as “Janitorial Supplies/Services.” One check affects both the bank account and a local fund, keeping the ending balances on the Financial Summary identical. | |||

Sometimes, to provide clarity, the check is divided between two different local funds. When that happens, the total of the local funds will always equal the total paid out from the bank account, keeping the bank and local funds in balance. | |||

If, while you are entering the check, the local funds totals do not exactly match the total of the check that is being written, Jewel will not let you proceed until they do. Jewel vigilantly ensures that the bank account totals continue to match the local/conference fund totals. | |||

'''Entering Offerings''': When entering an offering into Jewel, information about the donation is also entered in two places. | |||

When you enter an offering, whether entered as cash or a check, it increases the balance in this bank account by the amount of the offering, say $25. But Jewel won’t let you stop there. | |||

You have to also enter the same amount into the local or conference fund destination that your donor has chosen, so the donor’s instructions can be documented and followed. This increases the balance in Tithe, Church Budget, etc, which keeps the local/conference fund’s totals in line with the bank account totals. Same money, entered two ways. | |||

If you try to close the envelope but the totals don’t match, Jewel will give you a reminder, and won’t allow you to proceed until the local/conference fund destination totals match the total that is being posted to the bank account. | |||

'''Deposits that are not offerings:''' Occasionally you need to make and record a deposit to the bank that is not a donation, such as rental income, a refund from a vendor, or a check from the conference, using a “[[General Journal Entry]]”. Here you will enter the amount of the deposit, twice. This increases the bank account balance and increases a local account balance by the same amount, recording the same deposit two ways. | |||

Are you seeing a pattern here? | |||

'''Expenses that are not payments or purchases:''' Bank Fees and bank adjustments needed during reconciliations are also recorded as “[[General Journal Entries]].” Again, you have a place to enter the amount of the expense in two places, which decreases the bank account balance and also decreases a local account balance, recording the same money two ways while keeping the bank and local fund ending balances identical. | |||

And just like with Deposits and Checks, if the local fund “Account(s)” line does not match the amount on the “Bank Account” line, Jewel won’t let you proceed until it does, ensuring that the account totals stay in balance. | |||

These balance scales will help to illustrate the relationship of the bank accounts, local funds and conference funds, as | |||

deposits and payments come and go. Bank accounts on the left, local and conference funds on the right. | |||

Remember: Each real dollar in checking and | |||

savings is matched and represented by a | |||

dollar, on paper, in one of the local/conference | |||

funds. | |||

At the beginning of the month, this church has | |||

a total of $25,000 in savings and checking bank | |||

accounts, combined. | |||

This same amount is found in the local funds, | |||

since the conference funds were paid at the | |||

end of last month and no new offerings have | |||

been entered yet, so “conference funds” has a | |||

zero balance. | |||

By the end of the month, $14,000 in offerings | |||

has been deposited into checking. | |||

$9,000 was donated to conference funds. | |||

$5,000 was donated to local funds. | |||

Bank accounts and local and conference funds | |||

have both increased by $14,000. | |||

The totals on both sides match at $39,000. | |||

The savings bank account didn’t change, since | |||

all the offerings were deposited to the checking | |||

account. | |||

As part of the month-end closing, the | |||

conference funds are remitted from | |||

checking, decreasing the checking | |||

account ending balance by $9,000. | |||

Conference funds decrease by $9,000, | |||

leaving a zero balance. | |||

The local church funds and the savings | |||

account stay the same. | |||

The total bank and total local/conference | |||

funds still match at $30,000. | |||

5 | |||

During that month, $5,000 | |||

is paid out as expenses. | |||

The checking account | |||

decreases by 5,000. | |||

Savings stays the same. | |||

Various local church funds | |||

such as utilities and | |||

supplies decrease by a | |||

total of $5,000. | |||

The total bank and total | |||

local/conference funds | |||

continue to mirror each | |||

other, now at $25,000. | |||

Note how this ebb and flow process works in your own church’s Financial Summary. | |||

Becoming familiar with the way the three Financial Summary sections document the same money but serve different | |||

purposes will help you in the last three parts of this series. | |||

Revision as of 19:18, 25 December 2025

- NOTE: To comply with denomination policies, state and IRS laws and to prevent fraud, our church treasurers keep detailed records of all financial transactions, both incoming and outgoing. Jewel preserves these records and creates various reports so that the board can monitor the church’s financial health and make good financial decisions.

Three Sections

Each Jewel “Financial Summary” consists of three sections. Your church’s Financial Summary, no matter how long and complex or how short and simple, has these same three sections.

The Bank Accounts section in Jewel gives you an overview of how much money your church has and where it is being kept. Bank accounts have real money in them where you can deposit offerings, pay bills, and make purchases based on your church’s balances. If you have more than one bank account, Jewel keeps track of each bank account separately and gives you a total balance as well.

The Local Funds are designed to duplicate and itemize, on paper, the real money that is in your bank accounts. There are very specific rules about how donated money - Trust Funds - can be used, and since local funds document where the money came from and where the donor requested it to go, the local funds help us follow those rules.

Local Funds are not actual physical accounts with actual money in them. They are a second set of records - numbers on paper - keeping track of the very same money that is in the bank accounts, but in a more comprehensive and detailed way. And, if set up and used properly, they can also be used to track expenses in order to facilitate budgeting and long- range planning.

The Conference Funds section keeps a record of tithes and other donations that are to be passed on to the Conference in the monthly remittance. Note that after the remittance check has been written at the end of each month, the Conference Funds section will have a zero balance until another offering is entered that includes tithes or other conference offerings.

Each Dollar - Two Ways

The Financial Summary keeps track of your church’s money in two different ways. Every real dollar in each bank account is duplicated and documented, in detail, in either a local fund or a conference fund.

Keeping track of the same money two ways can be confusing if you don’t understand how it works. Sometimes board members think that they have the funds from the bank accounts PLUS the money in the local funds, but it doesn’t work that way. You only have the real money that is in your church’s bank accounts.

And since every penny in the bank account(s) has been assigned a purpose and we must document that purpose, we track and secure that purpose in the Local Funds section.

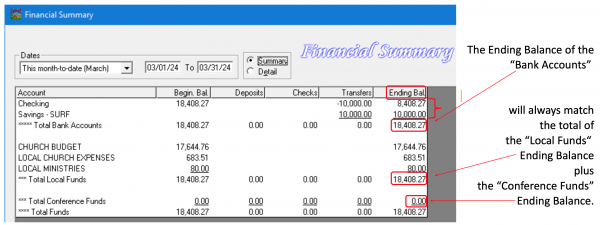

To illustrate this keeping track of the same money two ways, the following Financial Summary shows that:

Every dollar that is itemized in the Local Funds and the Conference Funds represents a real dollar that is currently in one of the church’s Bank Accounts.

These three sections serve separate and distinct purposes, yet are connected and work together to help you keep track of how much your church has, where the money came from and where it is going.

Look at your church’s Financial Summary through the next few weeks. Identify the three sections. Watch how the numbers in the Ending Balances column change as you enter offerings and make payments. But note that, as money is spent and offerings are deposited, the “Total Bank Accounts Ending Balance” is always the same as the “Total Local Funds” plus the “Total Conference Funds.”

Three sections, working together to give your board the information it needs to do its job.

Keeping Things Balanced

Writing checks: Have you ever noticed that, when you write a check in Jewel, you have to enter the amount of the check twice?

If you write a check to Walmart for $376.41, it decreases the balance of this checking account by $376.41. But you must also subtract $376.41 from a local fund, such as “Janitorial Supplies/Services.” One check affects both the bank account and a local fund, keeping the ending balances on the Financial Summary identical.

Sometimes, to provide clarity, the check is divided between two different local funds. When that happens, the total of the local funds will always equal the total paid out from the bank account, keeping the bank and local funds in balance.

If, while you are entering the check, the local funds totals do not exactly match the total of the check that is being written, Jewel will not let you proceed until they do. Jewel vigilantly ensures that the bank account totals continue to match the local/conference fund totals.

Entering Offerings: When entering an offering into Jewel, information about the donation is also entered in two places.

When you enter an offering, whether entered as cash or a check, it increases the balance in this bank account by the amount of the offering, say $25. But Jewel won’t let you stop there.

You have to also enter the same amount into the local or conference fund destination that your donor has chosen, so the donor’s instructions can be documented and followed. This increases the balance in Tithe, Church Budget, etc, which keeps the local/conference fund’s totals in line with the bank account totals. Same money, entered two ways.

If you try to close the envelope but the totals don’t match, Jewel will give you a reminder, and won’t allow you to proceed until the local/conference fund destination totals match the total that is being posted to the bank account.

Deposits that are not offerings: Occasionally you need to make and record a deposit to the bank that is not a donation, such as rental income, a refund from a vendor, or a check from the conference, using a “General Journal Entry”. Here you will enter the amount of the deposit, twice. This increases the bank account balance and increases a local account balance by the same amount, recording the same deposit two ways. Are you seeing a pattern here?

Expenses that are not payments or purchases: Bank Fees and bank adjustments needed during reconciliations are also recorded as “General Journal Entries.” Again, you have a place to enter the amount of the expense in two places, which decreases the bank account balance and also decreases a local account balance, recording the same money two ways while keeping the bank and local fund ending balances identical.

And just like with Deposits and Checks, if the local fund “Account(s)” line does not match the amount on the “Bank Account” line, Jewel won’t let you proceed until it does, ensuring that the account totals stay in balance.

These balance scales will help to illustrate the relationship of the bank accounts, local funds and conference funds, as deposits and payments come and go. Bank accounts on the left, local and conference funds on the right. Remember: Each real dollar in checking and savings is matched and represented by a dollar, on paper, in one of the local/conference funds. At the beginning of the month, this church has a total of $25,000 in savings and checking bank accounts, combined. This same amount is found in the local funds, since the conference funds were paid at the end of last month and no new offerings have been entered yet, so “conference funds” has a zero balance. By the end of the month, $14,000 in offerings has been deposited into checking. $9,000 was donated to conference funds. $5,000 was donated to local funds. Bank accounts and local and conference funds have both increased by $14,000. The totals on both sides match at $39,000. The savings bank account didn’t change, since all the offerings were deposited to the checking account. As part of the month-end closing, the conference funds are remitted from checking, decreasing the checking account ending balance by $9,000. Conference funds decrease by $9,000, leaving a zero balance. The local church funds and the savings account stay the same. The total bank and total local/conference funds still match at $30,000. 5 During that month, $5,000 is paid out as expenses. The checking account decreases by 5,000. Savings stays the same. Various local church funds such as utilities and supplies decrease by a total of $5,000. The total bank and total local/conference funds continue to mirror each other, now at $25,000. Note how this ebb and flow process works in your own church’s Financial Summary. Becoming familiar with the way the three Financial Summary sections document the same money but serve different purposes will help you in the last three parts of this series.