Bank Rec Comparison for Monthly Oversight: Difference between revisions

(Created page with "==Information for the Church Board== At the very bottom of each “Bank Reconciliation Report,” there is a line called the “Adjusted Bank Balance.” That number takes the “Bank Statement Ending Balance” for a certain date, adds and subtracts all the “Cleared” and “Uncleared” items in Jewel, and comes up with an “Adjusted Bank Balance” that matches the “Bank Account Ending Balance” on the Financial Summary for that same date. File:Bank Rec Comp...") |

No edit summary |

||

| (7 intermediate revisions by the same user not shown) | |||

| Line 1: | Line 1: | ||

==Information for the Church Board== | ==Information for the Church Board== | ||

[[File:Bank Rec Comparison 1.png|right|300px]] | |||

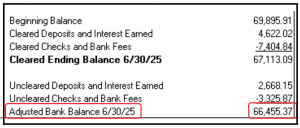

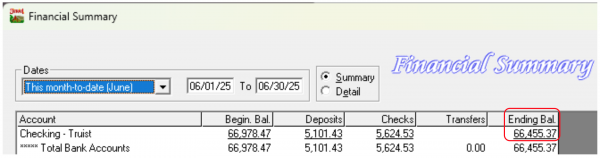

At the very bottom of each “Bank Reconciliation Report,” there is a line called the “Adjusted Bank Balance.” That number takes the “Bank Statement Ending Balance” for a certain date, adds and subtracts all the “Cleared” and “Uncleared” items in Jewel, and comes up with an “Adjusted Bank Balance” that matches the “Bank Account Ending Balance” on the Financial Summary for that same date. | At the very bottom of each “Bank Reconciliation Report,” there is a line called the “Adjusted Bank Balance.” That number takes the “Bank Statement Ending Balance” for a certain date, adds and subtracts all the “Cleared” and “Uncleared” items in Jewel, and comes up with an “Adjusted Bank Balance” that matches the “Bank Account Ending Balance” on the Financial Summary for that same date. | ||

[[File:Bank Rec Comparison 2.png|center|600px]] | [[File:Bank Rec Comparison 2.png|center|600px]] | ||

| Line 17: | Line 17: | ||

Church financial fraud, whether bank, cyber, mail, or embezzlement, is increasing every year. If your treasurer is not reconciling the church checking account monthly, your church funds are in danger. If bank fraud happens and it is not caught in a few weeks, banks can refuse to reimburse what was lost, and there are churches here in our conference that have lost hundreds or thousands of dollars because they were not reconciling in a timely fashion. Up to date and accurate reports are now, more than ever, crucial to your church’s financial health. | Church financial fraud, whether bank, cyber, mail, or embezzlement, is increasing every year. If your treasurer is not reconciling the church checking account monthly, your church funds are in danger. If bank fraud happens and it is not caught in a few weeks, banks can refuse to reimburse what was lost, and there are churches here in our conference that have lost hundreds or thousands of dollars because they were not reconciling in a timely fashion. Up to date and accurate reports are now, more than ever, crucial to your church’s financial health. | ||

To ensure that the monthly reports and balances are accurate and that all bank transactions are authorized, a trusted individual should be designated by the board to compare monthly bank statements to the Jewel bank reconciliations. [[Follow this link]] for instructions that should be printed off for that individual to follow. | To ensure that the monthly reports and balances are accurate and that all bank transactions are authorized, a trusted individual should be designated by the board to compare monthly bank statements to the Jewel bank reconciliations. [[Media:Bank Rec Comparison Form.pdf|Follow this link]] for instructions that should be printed off for that individual to follow. | ||

The comparison can be done in just a few minutes before or after the monthly board meeting. | The comparison can be done in just a few minutes before or after the monthly board meeting. | ||

| Line 35: | Line 35: | ||

After they have verified the above items, the authorized person should sign their name and the date at the top of the | After they have verified the above items, the authorized person should sign their name and the date at the top of the | ||

bank reconciliation report and give it back to the church treasurer to be filed. | bank reconciliation report and give it back to the church treasurer to be filed. | ||

----- | |||

[[Fraud Prevention for Churches|Click here for more topics related to Fraud Prevention for Churches]] | |||

[[Bank Reconciliation|Click here for more topics related to Bank Reconciliation]] | |||

Latest revision as of 23:28, 29 December 2025

Information for the Church Board

At the very bottom of each “Bank Reconciliation Report,” there is a line called the “Adjusted Bank Balance.” That number takes the “Bank Statement Ending Balance” for a certain date, adds and subtracts all the “Cleared” and “Uncleared” items in Jewel, and comes up with an “Adjusted Bank Balance” that matches the “Bank Account Ending Balance” on the Financial Summary for that same date.

If you were to compare Jewel’s “Financial Summary Ending Balance” and the “Ending Balance” of the bank statement at the end of any given month, you would notice that they don’t match. In fact, the difference is often in the thousands of dollars! Because of this, the board cannot just look at Jewel and look at the statement and verify that the information in Jewel is accurate.

This is why.

The June Check Report in Jewel tells you what checks were written in June. While the June bank statement tells you which of those checks actually cleared your bank in June, which is not the same. Some checks that you wrote in June won’t get cashed until July or even later.

Jewel deducts the money from the “Ending Balance” as soon as you write the check, before it is mailed or received or cashed. Even if you never mail it and it sits in your drawer, until you actually void it, Jewel still counts it as gone. (That keeps you from spending money that has already been committed to something/someone else.) But the bank counts the money as still yours until the moment it leaves the bank for somewhere else. So there can be a considerable time lag between Jewel considering it gone and it actually being gone from your bank. Which means that Jewel's end of month totals and the bank's end of month totals won't ever match.

But the church board needs to know that Jewel and the Bank totals are in sync, that they agree even if they don’t match. So, to fix this time lag problem, Jewel produces a Bank Rec Report every time you Reconcile, and this report produces the Adjusted Bank Balance.

Church financial fraud, whether bank, cyber, mail, or embezzlement, is increasing every year. If your treasurer is not reconciling the church checking account monthly, your church funds are in danger. If bank fraud happens and it is not caught in a few weeks, banks can refuse to reimburse what was lost, and there are churches here in our conference that have lost hundreds or thousands of dollars because they were not reconciling in a timely fashion. Up to date and accurate reports are now, more than ever, crucial to your church’s financial health.

To ensure that the monthly reports and balances are accurate and that all bank transactions are authorized, a trusted individual should be designated by the board to compare monthly bank statements to the Jewel bank reconciliations. Follow this link for instructions that should be printed off for that individual to follow.

The comparison can be done in just a few minutes before or after the monthly board meeting.

This individual should verify that:

- Bank reconciliations are being done every month (check the date to see if it is the most recent statement).

- Any adjustments on Jewel’s Bank Reconciliation report are also found on the bank statement.

- The Cleared Ending Balance on Jewel’s Bank Reconciliation report should match the Ending Balance found on the bank statement.

- The Adjusted Bank Balance on Jewel’s Bank Reconciliation report should match the bank account Ending Balance on that month’s Jewel Financial Summary.

If the answer is No on any of the above, or if the treasurer or any board member notes any one of the following on any Jewel Bank Reconciliation report, the auditor should be called for assistance.

- An outstanding check older than 6 months

- An uncleared deposit more than 30 days old

- Any odd item that is uncleared, such as an old adjustment

- Any unexplained difference.

After they have verified the above items, the authorized person should sign their name and the date at the top of the bank reconciliation report and give it back to the church treasurer to be filed.

Click here for more topics related to Fraud Prevention for Churches